What is Intraday Trading?

The Essential Guide to Intraday Trading: Strategies, Risks, and Rewards

What is Intraday Trading?

Intraday trading, a fascinating financial venture, is the practice of buying and selling stocks within the same trading day. The goal is to profit from short-term price movements in highly liquid stocks or indices. Unlike traditional investing, intraday trading focuses on short-term gains, making it a dynamic and sometimes volatile endeavor.

Understanding the Basics of Intraday Trading

Intraday trading is akin to a high-speed chess game, where quick decisions and strategic moves are paramount. Traders must understand market trends, stock behaviors, and have a keen eye for detail. It’s not just about buying low and selling high; it’s about understanding market psychology, technical analysis, and the impact of global events on stock prices.

The Role of Market Analysis in Intraday Trading

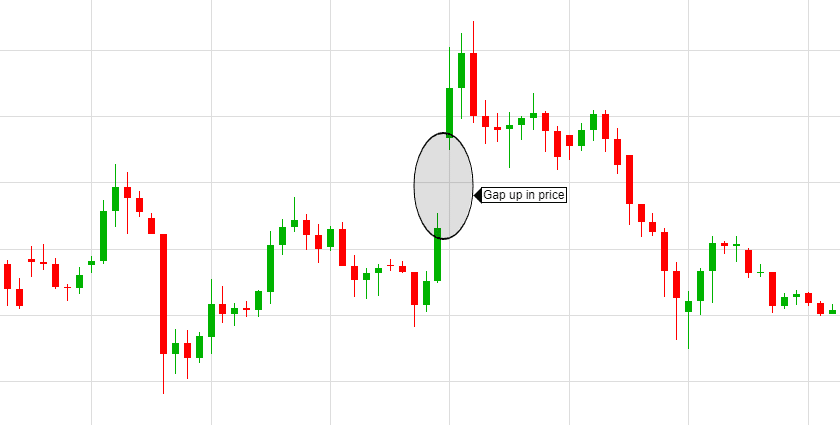

Market analysis is the compass guiding intraday traders. Technical analysis, involving charts and historical data, helps predict future price movements. Fundamental analysis, on the other hand, looks at company performance and industry trends. Successful traders often blend these approaches to gain a comprehensive market view.

Risk Management Strategies in Intraday Trading

Risk management is the safety net in the high-wire act of intraday trading. Setting stop-loss orders, which automatically sell a stock at a predetermined price, is crucial to limit potential losses. Diversifying trades and not putting all eggs in one basket also helps mitigate risks.

Psychological Aspects of Intraday Trading

Intraday trading is not just a test of skill but also of emotional and mental strength. The pressure of making quick decisions can be overwhelming. Successful traders maintain discipline, manage stress, and don’t let emotions like fear or greed dictate their trading decisions.

Advanced Intraday Trading Techniques

Advanced techniques like scalping, where traders make numerous trades to profit from small price changes, and swing trading, which involves holding stocks for several days to capitalize on expected upward or downward market shifts, are popular among experienced traders. Algorithmic trading, using computer programs to execute trades based on predefined criteria, is also gaining traction.

The Impact of Global Events on Intraday Trading

Global events, be it political upheavals, economic announcements, or natural disasters, can cause significant market volatility. Intraday traders must stay abreast of global news, as these events can offer opportunities for high profits but also come with increased risks.

Intraday Trading Tools and Resources

A plethora of tools are available to intraday traders. Trading platforms like MetaTrader or Thinkorswim offer advanced charting tools, real-time data, and analytical resources. Mobile apps allow traders to trade on the go, while financial news websites provide up-to-date market news and analysis.

Legal and Regulatory Considerations in Intraday Trading

Intraday trading is subject to regulatory oversight to prevent fraud and protect investors. Regulations vary by country but often involve disclosure requirements, capital requirements, and rules against manipulative trading practices. Traders must stay informed about these regulations to ensure compliance.

The Future of Intraday Trading

The future of intraday trading looks bright, with technological advancements like AI and machine learning poised to revolutionize how trading decisions are made. However, traders must also be wary of increased competition and the potential for regulatory changes.

FAQs

- How much capital is required to start intraday trading? The capital required for intraday trading varies based on the trader’s strategy and the market they are trading in. Generally, a few thousand dollars can be a good starting point. However, it’s important to trade only with money that you can afford to lose, as intraday trading carries significant risks.

- What are the most common mistakes made by new intraday traders? New intraday traders often make mistakes like overtrading, not setting stop-loss limits, inadequate market analysis, and letting emotions drive their trading decisions. It’s crucial to have a disciplined approach, a well-thought-out strategy, and an understanding of market dynamics.

- How does one choose the right stocks for intraday trading? Choosing the right stocks for intraday trading involves looking for stocks with high liquidity, moderate to high volatility, and a strong correlation with major market indices. It’s also important to stay informed about current events and company news that could impact stock prices.

- Can intraday trading be a full-time career? Yes, intraday trading can be pursued as a full-time career, but it requires a deep understanding of the markets, a robust trading strategy, and the ability to manage risks effectively. It also demands continuous learning and adaptability to changing market conditions.

- What is the role of brokerage in intraday trading? A brokerage plays a crucial role in intraday trading by providing access to trading platforms, necessary tools for market analysis, and executing trades. They also offer leverage, which allows traders to trade larger amounts with a smaller capital base. However, leverage increases both potential gains and losses.

- How does one stay updated with market trends for effective intraday trading? Staying updated with market trends involves regularly following financial news, using market analysis tools, and subscribing to relevant newsletters and reports. Many traders also use social media and financial blogs to keep up with real-time market updates and expert opinions.

Conclusion

Intraday trading offers a world of opportunities for those willing to navigate its complexities. From understanding the basics to mastering advanced techniques, this guide provides a comprehensive overview of what it takes to succeed in the dynamic world of intraday trading.

Happy Trading,

About The Author:

Billy Ribeiro is a renowned name in the world of financial trading, particularly for his exceptional skills in options day trading and swing trading. His unique ability to interpret price action has catapulted him to global fame, earning him the recognition of being one of the finest price action readers worldwide. His deep comprehension of the nuances of the market, coupled with his unparalleled trading acumen, are widely regarded as second to none.

Connect with us: