Understanding the Four Cycles of the Stock Market

Understanding the Four Cycles of the Stock Market: A Comprehensive Guide

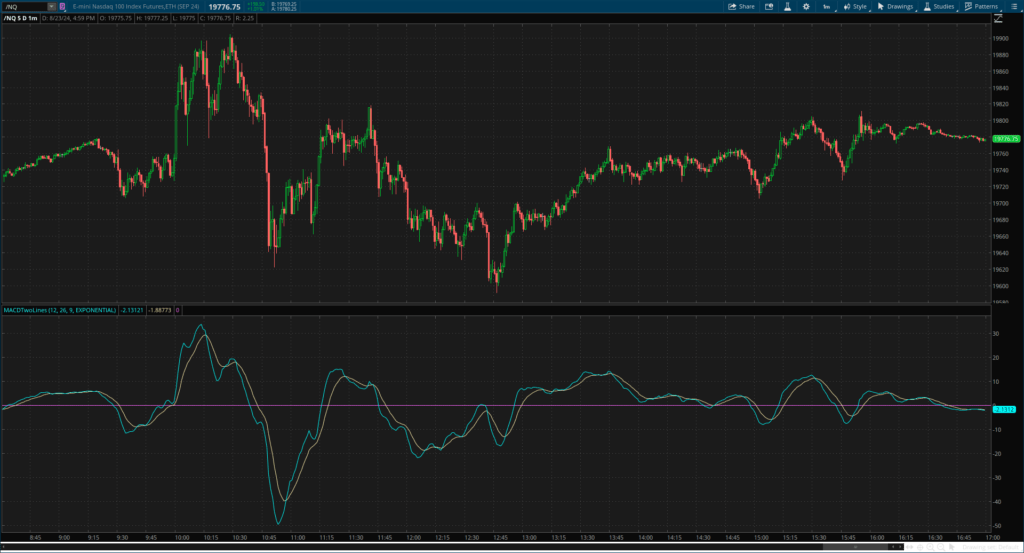

The stock market, an ever-evolving and dynamic entity, presents various cycles that are pivotal for investors and traders alike. Understanding these cycles is not just about recognizing patterns; it’s about gaining a deeper insight into the market’s heartbeat.

The Essence of Stock Market Cycles

To comprehend the stock market’s behavior, one must first recognize its cyclical nature. These cycles represent the ebb and flow of market sentiment, influenced by a plethora of factors ranging from economic indicators to geopolitical events.

Breaking Down the Four Major Cycles

- The Accumulation Phase

- Defining the Phase: This phase is characterized by a trend of stabilization following a period of decline. Savvy investors start accumulating stocks, anticipating future gains.

- Identifying Opportunities: How to spot potential in this phase and what metrics to consider.

- Risks and Rewards: Analyzing the risk-reward ratio in the accumulation phase.

- The Markup Phase

- Rising Tides in the Market: Understanding how positive sentiment and improving fundamentals drive prices up.

- Strategies for Growth: Optimal investment strategies to maximize profits during this phase.

- Signs of Sustainability: Evaluating whether the growth is sustainable or a prelude to a bubble.

- The Distribution Phase

- The Turning Point: Identifying the shift from bullish to bearish trends.

- Strategic Exit Plans: Knowing when to exit or adjust your investment portfolio.

- Impact of External Factors: How external events can precipitate or prolong this phase.

- The Markdown Phase

- Navigating the Downturn: Effective strategies to manage investments during market declines.

- Seeking Safe Havens: Exploring safer investment options in a bear market.

- Long-Term Perspectives: Understanding the importance of long-term planning in this phase.

The Accumulation Phase: A Closer Look

The accumulation phase marks the beginning of the market cycle. It’s a period where astute investors, often called ‘smart money’, start buying stocks, despite the prevailing negative sentiment. This phase is often hard to identify in real-time as the market sentiment is still bearish.

The Markup Phase: Growth and Prosperity

Following the accumulation phase, the market enters the markup phase. During this period, stock prices start to rise consistently, often driven by positive news, strong earnings reports, and an improving economic outlook.

The Distribution Phase: Signs of Caution

The distribution phase signals a turning point. Here, investors who have accumulated stocks in the earlier phases start to sell, leading to a plateau in stock prices. This phase requires a strategic approach to safeguard gains.

The Markdown Phase: Weathering the Storm

The final phase, the markdown phase, is characterized by a decline in stock prices. This phase can be challenging for investors as it’s often accompanied by widespread pessimism and negative market sentiment.

Understanding the Four Cycles of the Stock Market

The importance of understanding these cycles lies in the ability to make informed decisions. Each phase offers different challenges and opportunities, and a keen understanding of these can lead to better investment strategies.

Frequently Asked Questions

-

- How long does each stock market cycle typically last? The duration of each stock market cycle can vary greatly and is influenced by a multitude of factors, including economic conditions, investor sentiment, and global events. Typically, a complete market cycle can last anywhere from a few years to a decade. However, it’s important to note that these cycles are not predictable in terms of exact duration.

- What are the key indicators to identify each phase of the market cycle?

- Accumulation Phase: Look for signs of stabilization after a downturn, increased buying interest from savvy investors, and improved fundamentals despite lingering negative sentiment.

- Markup Phase: Indicators include consistently rising stock prices, positive economic reports, strong corporate earnings, and overall bullish investor sentiment.

- Distribution Phase: Key signs include plateauing stock prices, increased selling by early investors, and a shift towards more cautious or bearish sentiment.

- Markdown Phase: Indicators are a general decline in stock prices, negative market sentiment, poor economic indicators, and a decrease in trading volume.

- How can investors protect their portfolio during the markdown phase? Investors can protect their portfolios by diversifying their investments across different asset classes, sectors, and geographical locations. It’s also prudent to have a mix of growth and value stocks, and consider safe-haven assets like bonds or gold. Additionally, setting stop-loss orders to limit potential losses and keeping some cash reserves for buying opportunities at lower prices can be beneficial.

- Is it possible to predict the start and end of each market cycle accurately? Accurately predicting the start and end of market cycles is extremely challenging due to the complex interplay of various economic, political, and social factors. While investors and analysts can identify general trends and potential signals, the stock market is inherently unpredictable, and exact timings cannot be determined with certainty.

- How do geopolitical events impact these cycles? Geopolitical events can have significant impacts on the stock market cycles. For instance, political instability, trade wars, or international conflicts can lead to market uncertainty, affecting investor sentiment and economic conditions. Such events can hasten the transition between different phases of the market cycle or prolong specific phases, depending on the nature and severity of the event.

Conclusion

Understanding the four cycles of the stock market is crucial for anyone involved in investing. It’s not just about timing the market but about recognizing patterns, understanding underlying factors, and making informed decisions. By comprehending these cycles, investors can better navigate the complexities of the stock market and make more strategic investment choices.

Good luck,

About The Author:

Billy Ribeiro is a renowned name in the world of financial trading, particularly for his exceptional skills in options day trading and swing trading. His unique ability to interpret price action has catapulted him to global fame, earning him the recognition of being one of the finest price action readers worldwide. His deep comprehension of the nuances of the market, coupled with his unparalleled trading acumen, are widely regarded as second to none.

Connect with us: