Price-to-Earnings (P/E) Ratio: Definition, Formula, and Examples

Price-to-Earnings (P/E) Ratio:

Definition, Formula, and Examples

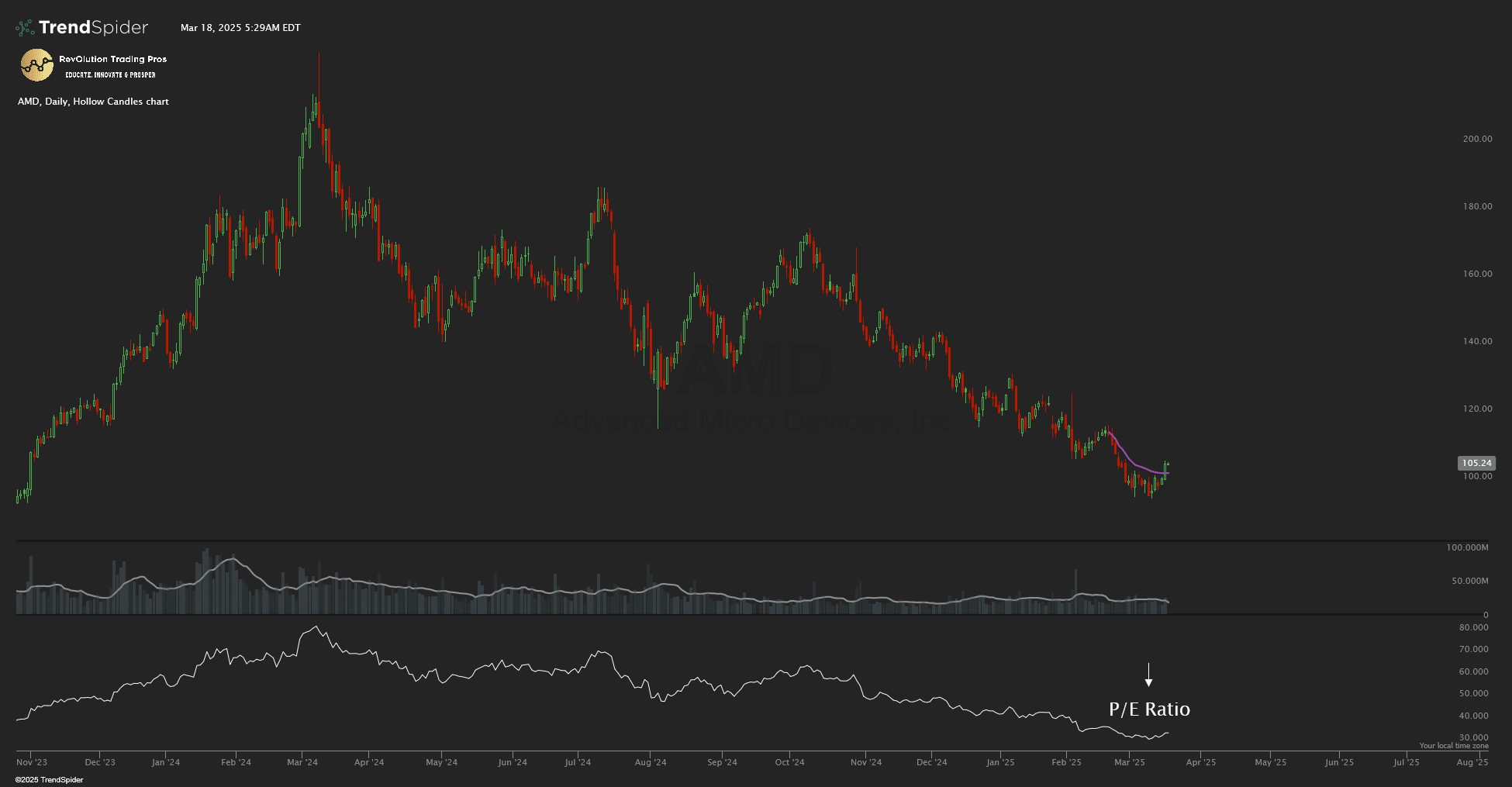

The price-to-earnings (P/E) ratio is one of the most essential financial tools investors use to determine whether a company’s stock is appropriately valued compared to its earnings. Mastering this concept can significantly enhance your investment decisions, allowing you to identify stocks that are either undervalued or overvalued. This guide provides a comprehensive yet straightforward understanding of the keyword, helping even beginners grasp its importance and application.

What Exactly is the Price-to-Earnings (P/E) Ratio?

The price-to-earnings (P/E) ratio is a straightforward metric comparing a company’s share price to its earnings per share (EPS). Essentially, it tells investors how much they are paying for every dollar earned by the company. A higher P/E suggests optimism about the company’s future growth, whereas a lower P/E might indicate an undervalued stock or skepticism about future prospects.

Calculating the Price-to-Earnings (P/E) Ratio

Calculating the price-to-earnings (P/E) ratio involves a simple formula:

P/E Ratio = Share Price ÷ Earnings Per Share (EPS)

- Share Price: The current market price of one share.

- EPS: Total net earnings divided by the number of outstanding shares.

Example: If a company’s stock price is $50, and its EPS is $2, the P/E ratio is 25. Investors are paying $25 for each dollar of earnings.

Types of Price-to-Earnings (P/E) Ratios Explained

There are two primary types of P/E ratios used by investors:

Trailing Price-to-Earnings (P/E) Ratio

The trailing P/E ratio looks at past earnings, specifically over the last 12 months. It’s useful for analyzing historical performance but doesn’t consider potential future changes or growth.

Forward Price-to-Earnings (P/E) Ratio

The forward P/E ratio uses projected future earnings provided by analysts or the company itself. While it helps investors assess future growth potential, it can be subject to inaccuracies since it relies on estimates.

Action Tip: For a balanced view, investors should consider both trailing and forward P/E ratios to understand historical performance alongside future expectations.

Practical Application of the Price-to-Earnings (P/E) Ratio

Investors use the keyword in various practical ways, including:

- Comparing a company’s valuation against its industry peers.

- Evaluating if a stock is reasonably valued compared to historical trends.

- Determining how a stock compares to broader market averages, such as the S&P 500.

Real-World Example: Price-to-Earnings (P/E) Ratio in Action

Let’s consider two companies: Company A has a P/E ratio of 30, and Company B has a P/E ratio of 10. A higher P/E ratio for Company A suggests investors expect higher future growth, possibly indicating it might currently be overpriced. Company B, with a lower P/E, might appear undervalued or simply slower-growing. Understanding these differences helps investors make informed decisions about where to allocate their funds.

Limitations of the Price-to-Earnings (P/E) Ratio

Despite its usefulness, investors should recognize that the keyword has certain limitations:

- Ignores Debt and Cash: It does not factor in the company’s debt or cash reserves, potentially skewing the valuation.

- Sector Variability: Comparing P/E ratios across different industries can be misleading due to varying business cycles and growth expectations.

- Unprofitable Companies: Companies without earnings or those experiencing losses have undefined or irrelevant P/E ratios.

Action Tip: Combine the P/E ratio with other valuation metrics, such as Earnings Yield, EV/EBITDA, and Price-to-Sales (P/S), for a comprehensive analysis.

Alternatives and Complements to the Price-to-Earnings (P/E) Ratio

The keyword is valuable, but here are other helpful metrics to supplement your analysis:

Earnings Yield

The earnings yield is the inverse of the keyword, calculated as EPS divided by share price. It gives investors a sense of the return they can expect based on current earnings.

Price-to-Sales (P/S) Ratio

Ideal for evaluating younger or high-growth companies, the P/S ratio compares a company’s market cap to its total sales, especially helpful for businesses not yet profitable.

EV/EBITDA Ratio

This comprehensive valuation metric considers the company’s enterprise value relative to earnings before interest, taxes, depreciation, and amortization, offering a clearer picture of a company’s overall financial health.

Action Tip: Use multiple metrics to create a robust investing strategy and avoid reliance on just one valuation tool.

What is Considered a Good Price-to-Earnings (P/E) Ratio?

The concept of a “good” keyword can vary significantly based on industry standards, market conditions, and investor expectations:

- High P/E Ratio: Typically signals strong growth expectations but could also indicate overvaluation.

- Low P/E Ratio: Generally points towards potential undervaluation, but it might also reflect underlying issues or poor investor confidence.

Always contextualize the P/E ratio within the appropriate industry or sector to make accurate assessments.

Important Cautions When Using the Price-to-Earnings (P/E) Ratio

Investors should remain cautious about the keyword’s inherent limitations, such as:

- Earnings Manipulation: Companies may use creative accounting to inflate earnings.

- Debt Impact: High debt levels may artificially lower the P/E ratio, masking underlying risks.

- Sector Differences: Comparing across unrelated industries can produce misleading conclusions.

Action Tip: Always validate your keyword analysis with additional research, industry comparisons, and broader financial evaluations.

Frequently Asked Questions (FAQs) about the Price-to-Earnings (P/E) Ratio

What Does a P/E Ratio of 15 Mean?

A P/E ratio of 15 indicates investors pay $15 for each $1 of annual earnings the company generates.

Is a Higher or Lower P/E Ratio Better?

Generally, a lower P/E ratio indicates potential undervaluation, making it appealing to value investors, whereas a higher ratio suggests expectations of significant future growth.

Can a Company Have a Negative P/E Ratio?

Technically yes, but it’s usually represented as “N/A” due to the company’s negative earnings.

Why Use Forward P/E Instead of Trailing P/E?

Forward P/E offers insights into future performance expectations, making it particularly valuable for evaluating growth prospects.

Conclusion: Effectively Using the Price-to-Earnings (P/E) Ratio

Grasping the keyword is fundamental to successful investing. By combining the P/E ratio with complementary metrics and careful industry analysis, even novice investors can make more informed, strategic investment decisions. Remember, while the keyword is a powerful tool, always incorporate broader financial data and contextual information to achieve balanced, effective investment outcomes.

Frequently Asked Questions (FAQs) about the Price-to-Earnings (P/E) Ratio

What Does a P/E Ratio of 15 Mean?

A P/E ratio of 15 indicates investors pay $15 for each $1 of annual earnings.

Is a Higher or Lower P/E Ratio Better?

Generally, a lower P/E ratio indicates potential undervaluation, making it appealing to value investors, whereas a higher ratio suggests expectations of significant future growth.

Can a Company Have a Negative P/E Ratio?

Technically yes, but it’s usually represented as “N/A” due to the company’s negative earnings.

Why Use Forward P/E Instead of Trailing P/E?

Forward P/E offers insights into future performance expectations, making it particularly valuable for evaluating growth prospects.

Check out articles on:

- Introducing to Options Trading

- Mastering Butterfly Spreads

- The Power of Diagonal Spreads

- The Power of Iron Condors

- The Power of Vertical Credit Spreads

- How to Succeed Trading Stocks, and Stock Options in a Volatile Market

Elevate Your Options Trading Skills

Ready to master options? Join our community for in-depth education on options trading, live sessions, and expert analysis of options trading strategies. Sign up today to start profiting from market swings using advanced options trading strategies!

Below are the links:

- Day Trading Room

- Swing Trading Room(Short-term)

- Small Account Mentorship

- SPX Trading Alerts(Alerts Only)

- Revolution Swings(Alerts Only)

To your success,

Billy Ribeiro is a globally recognized trader renowned for his mastery of price action analysis and innovative trading strategies. He was personally mentored by Mark McGoldrick, famously known as “Goldfinger,” Goldman Sach’s most successful investor in history. McGoldrick described Billy Ribeiro as “The Future of Trading,” a testament to his extraordinary talent. Billy Ribeiro solidified his reputation by accurately calling the Covid crash bottom, the 2022 market top, and the reversal that followed, all with remarkable precision. His groundbreaking system, “The Move Prior to The Move,” enables him to anticipate market trends with unmatched accuracy, establishing him as a true pioneer in the trading world.

Connect with us: