Intraday Trading

Intraday Trading: Mastering the Art of the Day Trade

Intraday trading, a financial market strategy buzzing with energy and potential, opens a world of opportunities for those who can navigate its turbulent waters. Herein lies a comprehensive guide, illuminating the paths and pitfalls of this exhilarating endeavor.

Intraday Trading Basics: An Overview Intraday trading, the practice of buying and selling financial instruments within the same trading day, offers a fast-paced environment for traders. Here, we’ll cover its foundational principles, setting the stage for deeper insights.

Decoding Market Trends: The Trader’s Compass Understanding market trends is pivotal in intraday trading. This section delves into identifying and interpreting these trends, a skill paramount for success.

Risk Management: The Safety Net of Trading Risk management is the backbone of trading. This crucial topic discusses strategies to safeguard your investments, ensuring your trading journey is both profitable and secure.

Technical Analysis: The Trader’s Toolbox Technical analysis tools are the trader’s compass in the dynamic world of intraday trading. Explore various analytical tools and how they can be effectively employed.

Trading Psychology: The Mind Game Trading isn’t just about numbers; it’s a psychological journey. Here, we explore the mental aspects of trading, offering insights into maintaining balance and focus.

Intraday Trading Strategies: Pathways to Profit This section unveils various intraday trading strategies, guiding you through their application and nuances to enhance your trading approach.

Timing the Market: When to Strike Timing is everything in intraday trading. Learn about the best times to trade and how to spot those golden opportunities.

Leverage in Intraday Trading: A Double-Edged Sword Leverage can amplify gains but also losses. Understand how to use leverage wisely in intraday trading.

Choosing the Right Broker: Your Trading Ally The choice of broker can make or break your trading experience. Here’s what to look for when choosing a broker for intraday trading.

Chart Patterns: Reading the Market’s Language Chart patterns are the alphabet of the market’s language. This section teaches you how to read and interpret these patterns.

Candlestick Analysis: The Art of Price Prediction Candlestick analysis, a vital tool in a trader’s arsenal, offers insights into market sentiment. Learn how to interpret these formations.

Volume Analysis: Listening to the Market’s Pulse Volume analysis provides a deeper understanding of market movements. Discover how to use volume as an indicator in intraday trading.

Moving Averages: Simplifying the Market’s Complexities Moving averages smooth out market fluctuations, offering clearer insights. Learn how they can be used effectively in intraday trading.

Momentum Indicators: Capturing Market Movements Momentum indicators help traders identify the strength of market movements. Explore how to use these indicators for better decision-making.

Support and Resistance: The Market’s Battleground Support and resistance levels are crucial in understanding market dynamics. This section discusses how to identify and use these levels.

Trading Plan: Your Blueprint for Success A well-structured trading plan is essential. Learn how to create a plan that aligns with your goals and risk tolerance.

Day Trading vs. Swing Trading: Choosing Your Style Understand the differences between day trading and swing trading, and determine which aligns best with your trading style and objectives.

Futures and Options in Intraday Trading Explore how futures and options can be integrated into your intraday trading strategy for diversified market exposure.

Automated Trading Systems: The Tech-Savvy Trader’s Choice Automated trading systems can streamline the trading process. Discover the benefits and pitfalls of using these systems.

Keeping Up with Economic Indicators Economic indicators can significantly impact markets. Understand which indicators are crucial for intraday traders and how to interpret them.

Trading Journals: Tracking Your Journey Maintaining a trading journal is key to growth and improvement. Learn the benefits and methods of keeping an effective trading journal.

Intraday Trading in Forex: A World of Opportunities Forex markets offer unique opportunities for intraday traders. Explore the nuances of trading in the world’s largest financial market.

Cryptocurrency and Intraday Trading Cryptocurrency markets are an emerging field for intraday traders. Understand the risks and rewards of trading digital currencies.

Intraday Trading Regulations: Staying Within the Lines Staying informed about trading regulations is crucial. This section covers the essential regulations that intraday traders should be aware of.

Advanced Intraday Trading Techniques For the experienced trader, this section delves into advanced techniques and strategies to further refine your trading skills.

Intraday Trading Basics: An Overview

Intraday trading, the financial equivalent of a sprint, is an arena where fortunes can be made or lost in the blink of an eye. The essence of intraday trading lies in its name – it’s all about opening and closing trades within the same day, capitalizing on short-term market movements. This form of trading requires not only an understanding of the market’s pulse but also a keen sense of timing and a solid strategy.

Decoding Market Trends: The Trader’s Compass

Navigating the stormy seas of the stock market requires a compass, and for intraday traders, this compass is the ability to decode market trends. It’s about reading the subtle cues, the slight shifts in the market’s mood, and making informed decisions. Whether it’s identifying an uptrend with potential for growth or a downtrend signaling caution, the ability to interpret these trends is what separates successful traders from the rest.

Risk Management: The Safety Net of Trading

Ah, risk management – the unsung hero of trading. It’s the safety net that catches you when the high-wire act of trading teeters towards uncertainty. Effective risk management isn’t just about minimizing losses; it’s about making calculated moves, knowing when to hold back and when to leap forward. It involves setting stop-loss orders, understanding risk-reward ratios, and never putting all your eggs in one basket.

Technical Analysis: The Trader’s Toolbox

Intraday trading without technical analysis is like sailing without a map. This section is your map, guiding you through the maze of charts, indicators, and patterns. Technical analysis is more than just lines on a chart; it’s a window into the market’s soul, offering insights into future movements based on historical data. From simple moving averages to complex Fibonacci retracements, this toolbox is brimming with instruments that can help you predict market behavior.

Trading Psychology: The Mind Game

Don’t underestimate the power of the mind in trading. Fear, greed, hope – these aren’t just emotions; they’re the siren songs that can lead traders astray. Mastering the psychological aspects of trading is as crucial as understanding the market itself. It’s about maintaining discipline, managing emotions, and staying focused amid the market’s ups and downs.

Intraday Trading Strategies: Pathways to Profit

In the world of intraday trading, strategies are your pathways to profit. Whether it’s scalping, where you make quick, small profits, or momentum trading, where you ride the wave of market trends, each strategy has its unique flavor. This section explores various strategies, helping you find the one that resonates with your trading style and objectives.

Timing the Market: When to Strike

Timing, in intraday trading, is an art form. It’s about knowing when to enter and exit a trade, understanding the market’s rhythmic dance. Is it the calm before the storm or the quiet after? This section dives into the nuances of timing, helping you hone your instincts to spot those opportune moments.

Leverage in Intraday Trading: A Double-Edged Sword

Leverage is a powerful tool in the hands of an intraday trader, but it’s a double-edged sword. It can amplify your profits, but it can also magnify your losses. This section delves into the wise use of leverage, balancing the potential for higher returns against the increased risk.

Choosing the Right Broker: Your Trading Ally

Your broker is more than just a platform; they’re your ally in the trading battlefield. The right broker can enhance your trading experience, offering the tools, support, and resources you need. This section guides you through choosing a broker that aligns with your trading needs and goals.

Chart Patterns: Reading the Market’s Language

Chart patterns are the hieroglyphs of the trading world, telling stories of market movements and trader sentiments. Understanding these patterns is crucial for anticipating future price movements. This section teaches you how to decipher these patterns, turning them into actionable insights.

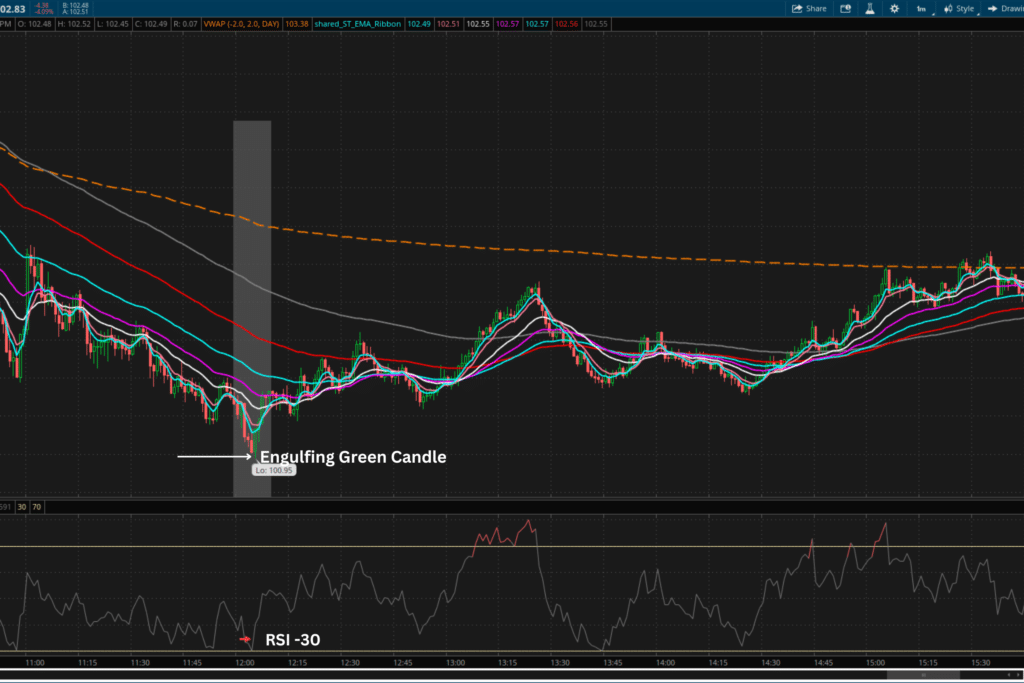

Candlestick Analysis: The Art of Price Prediction

Candlesticks are more than just pretty patterns on a chart; they’re a rich language of price movement and market emotion. This section explores the art of candlestick analysis, helping you interpret these formations to predict future market behavior.

Volume Analysis: Listening to the Market’s Pulse

Volume analysis is like putting your ear to the ground to hear the market’s heartbeat. It provides insights into the strength and sustainability of price movements. This section delves into using volume as a crucial indicator in your intraday trading decisions.

Moving Averages: Simplifying the Market’s Complexities

Moving averages are the smoothing iron of the financial market, ironing out the wrinkles of market fluctuations to reveal clearer trends. This section explores how moving averages can simplify market complexities, helping you make more informed trading decisions.

Momentum Indicators: Capturing Market Movements

Momentum indicators are the radar of intraday trading, detecting the speed and velocity of market movements. In a world where timing is everything, these indicators can be invaluable. They help you gauge the strength of a trend, whether it’s gaining steam or running out of gas. This section sheds light on various momentum indicators and how to use them to capture market movements effectively.

Support and Resistance

The Market’s Battleground The concepts of support and resistance are fundamental to understanding market dynamics. They represent the battleground where buyers and sellers wage war, pushing prices up and down. Identifying these levels can be crucial in making informed trading decisions. This part of the guide will help you understand how to spot and utilize these critical zones in your trading strategy.

Trading Plan

Your Blueprint for Success A ship without a course is destined to drift aimlessly. Similarly, a trader without a plan is likely to falter. Your trading plan is your blueprint, guiding your decisions and keeping you aligned with your goals. It should outline your strategy, risk tolerance, and specific criteria for entering and exiting trades. This section emphasizes the importance of having a well-thought-out trading plan and how to develop one that suits your trading style.

Day Trading vs. Swing Trading

Choosing Your Style Intraday trading and swing trading are two different approaches to the market, each with its own set of strategies and risks. Understanding the differences between these styles is crucial in determining which aligns best with your goals, risk appetite, and available time. This section explores these trading styles, helping you decide which path to tread.

Futures and Options in Intraday Trading Futures and options bring a different flavor to intraday trading, offering opportunities for hedging and leveraging your positions. However, they also come with their own set of risks and complexities. This part of the guide delves into how futures and options can be used in intraday trading, providing a deeper understanding of these financial instruments.

Automated Trading Systems

The Tech-Savvy Trader’s Choice In an age where technology reigns supreme, automated trading systems have become a popular tool among traders. These systems can execute trades automatically, based on predefined criteria, offering efficiency and speed. However, they also carry certain risks and limitations. This section explores the pros and cons of automated trading systems, helping you decide if they’re the right choice for you.

Keeping Up with Economic Indicators Economic indicators are the signposts that signal the health and direction of the economy. For intraday traders, staying abreast of these indicators is vital, as they can significantly impact market movements. This section discusses the key economic indicators you should be aware of and how to interpret their potential impact on the markets.

Trading Journals: Tracking Your Journey A trading journal is more than a record of your trades; it’s a tool for self-reflection and learning. By keeping a detailed journal, you can analyze your successes and mistakes, fine-tune your strategy, and grow as a trader. This part of the guide underscores the importance of a trading journal and offers tips on maintaining an effective one.

Intraday Trading in Forex

A World of Opportunities The Forex market, with its vast liquidity and 24-hour trading cycle, offers a unique playground for intraday traders. However, it also comes with its own set of challenges and risks. This section explores the intricacies of intraday trading in the Forex market, from currency pairs to the impact of global events.

Cryptocurrency and Intraday Trading The world of cryptocurrency is a new frontier for intraday traders, offering high volatility and potential rewards. However, this market is also fraught with risks and is highly unpredictable. This section delves into the nuances of trading cryptocurrencies, offering insights into how to navigate this emerging market.

Intraday Trading Regulations

Staying Within the Lines In the world of finance, regulations are the guardrails that keep the market in check. As an intraday trader, it’s essential to be aware of and comply with these regulations to avoid penalties and ensure a smooth trading experience. This section covers the key regulations affecting intraday traders and how to stay compliant.

Advanced Intraday Trading Techniques For those who have mastered the basics, advanced intraday trading techniques can offer new avenues for profit and growth. From algorithmic trading to complex derivatives strategies, this section explores more sophisticated approaches to intraday trading, designed for experienced traders looking to elevate their game.

FAQs

- What is the best time of day for intraday trading?

- How much capital do I need to start intraday trading?

- Can intraday trading be a full-time career?

- How do I manage risk in intraday trading?

- What are the most common mistakes made by new intraday traders?

- How does news impact intraday trading?

Conclusion

Intraday trading is not just a financial endeavor; it’s a journey that tests your skills, discipline, and resilience. Whether you’re a seasoned trader or a novice, there’s always more to learn, more strategies to explore, and more opportunities to seize. With the right approach, tools, and mindset, the world of intraday trading can be both rewarding and exhilarating. Remember, in the realm of the financial markets, knowledge is power, and staying informed and prepared is the key to success.

Happy trading,

About The Author:

Billy Ribeiro is a renowned name in the world of financial trading, particularly for his exceptional skills in options day trading and swing trading. His unique ability to interpret price action has catapulted him to global fame, earning him the recognition of being one of the finest price action readers worldwide. His deep comprehension of the nuances of the market, coupled with his unparalleled trading acumen, are widely regarded as second to none.

Connect with us: