Atomic Hedge

Atomic Hedge: The Secret Weapon for Smart Traders in 2025

Discover how Atomic Hedge strategies offer dynamic protection in volatile markets.

By Billy Ribeiro | Globally Recognized Trader & Market Strategist

Billy Ribeiro is a globally recognized trader renowned for his mastery of price action analysis and innovative trading strategies. He was personally mentored by Mark McGoldrick, famously known as “Goldfinger,” Goldman Sachs’s most successful investor in history. McGoldrick described Billy Ribeiro as “The Future of Trading,” a testament to his extraordinary talent. Billy Ribeiro solidified his reputation by accurately calling the Covid crash bottom, the 2022 market top, and the reversal that followed, all with remarkable precision. His groundbreaking system, “The Move Prior to The Move,” enables him to anticipate market trends with unmatched accuracy, establishing him as a true pioneer in the trading world.

What Is an Atomic Hedge?

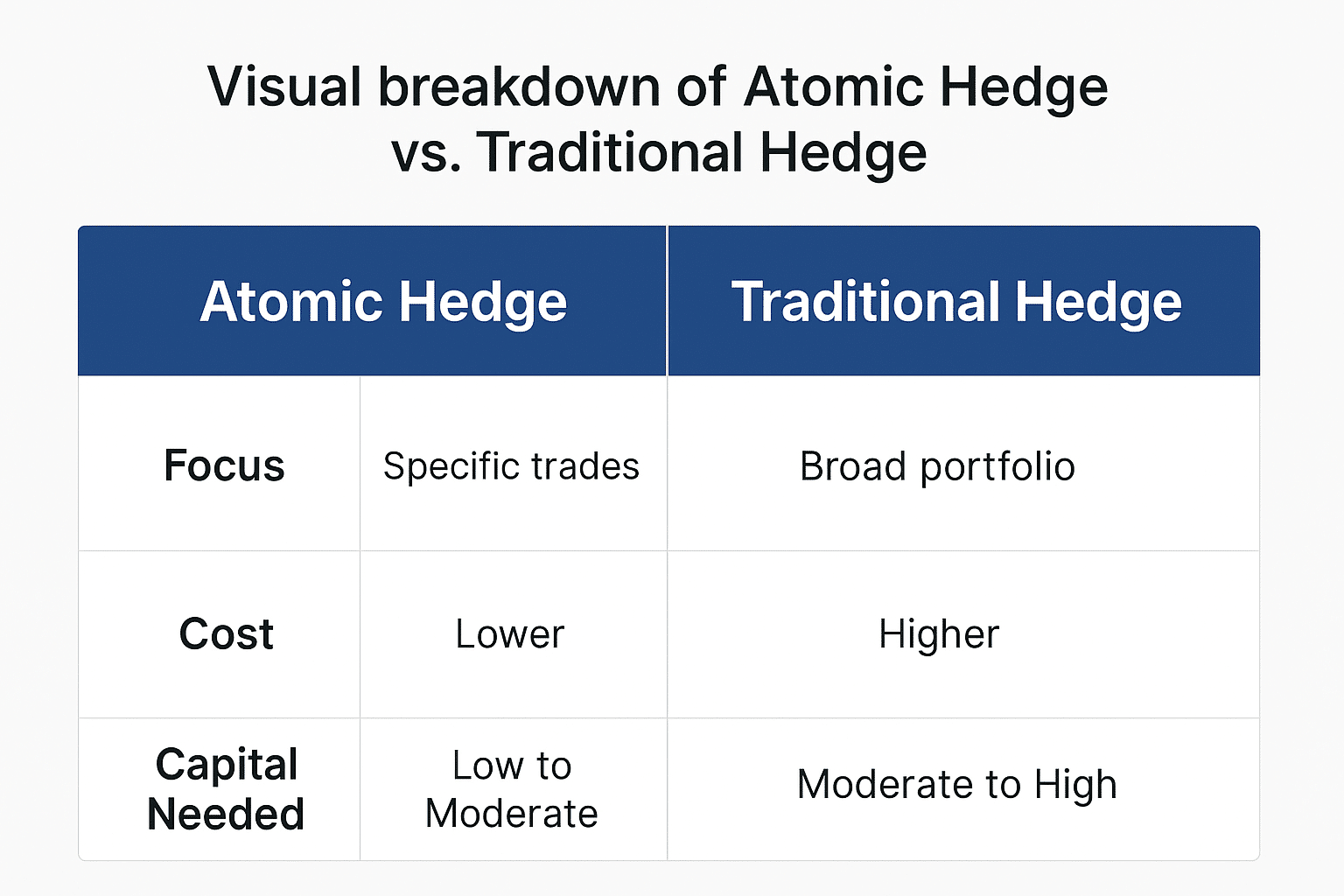

An atomic hedge is a precise, micro-level risk management strategy that allows traders to isolate and protect individual components of a larger trade or portfolio. Unlike traditional hedging that involves broad protection (like buying SPY puts to cover an entire portfolio), atomic hedging focuses on protecting specific positions with tailored, highly responsive instruments.

Think of it like this: If traditional hedging is like wearing full body armor, atomic hedging is like reinforcing just the most vulnerable areas. It is focused, capital-efficient protection.

How Atomic Hedge Strategies Work: Real Examples

Atomic hedges typically use derivatives like options, futures, or ETFs to hedge specific trade setups. The goal is to reduce directional exposure and mitigate volatility without over-hedging, which can eat into profits.

Table of Contents

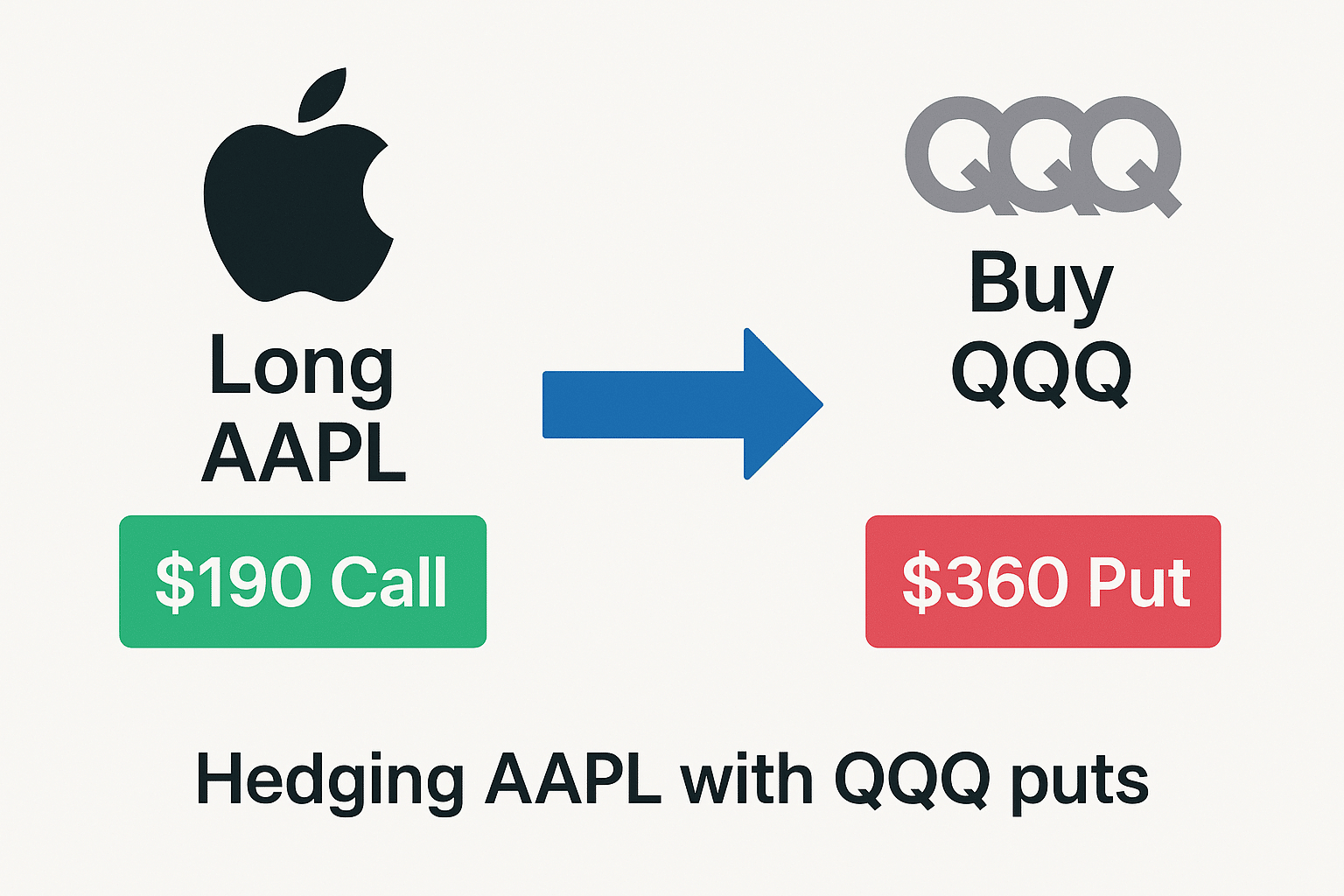

ToggleExample 1: Hedging a Long AAPL Call with QQQ Puts

Let’s say you’re bullish on Apple (AAPL) and buy a $190 call expiring in 30 days. However, you’re concerned about potential weakness in the tech sector overall. Instead of buying a costly put on AAPL itself, you buy a slightly out-of-the-money put on QQQ (the ETF that tracks the Nasdaq-100).

- If AAPL dips because of a broader tech selloff, your QQQ put will likely gain enough to offset some or all of the loss on your AAPL call.

- If AAPL runs while the rest of the market is flat, you can still realize most of the profit from your primary trade.

Example 2: Small Account Hedge Using SPY Put Spreads

You are holding bullish positions in AMD and NVDA and are concerned about a general market pullback. Instead of buying an expensive SPY put, you can use a put debit spread.

- Trade Setup: Buy a SPY $440 Put and simultaneously sell a SPY $435 Put for the same expiration.

- Purpose: This hedge costs significantly less than a naked put and gives you a defined-risk protection layer if the S&P 500 drops. This is a capital-efficient way to protect gains.

Benefits of Atomic Hedging

- Precision Risk Management: You’re not protecting everything—you’re targeting what matters most. This helps minimize unnecessary drag on profits.

- Capital Efficiency: By using spreads, inverse ETFs, or correlated instruments, atomic hedging keeps your capital working efficiently.

- Flexibility in Volatile Markets: Atomic hedges allow you to stay in your trades while strategically protecting against near-term catalysts like earnings or FOMC meetings.

Billy’s Take:

“Atomic hedging is what separates reactive traders from strategic operators. Instead of panicking and selling a good position because of short-term fear, you learn to build a temporary, precise shield around it. It’s a skill that lets you hold winners longer and with more confidence. For example, I will often hedge my basket of tech swing trades with a few short-dated QQQ puts ahead of a major CPI report.”

Common Mistakes When Using Atomic Hedges

- Over-Hedging: Trying to eliminate all risk often results in eliminating all your profit. The goal is protection, not profit suffocation.

- Ignoring Correlation: If you’re long AAPL but hedge with an industrial sector ETF during a tech-specific selloff, your hedge may not work. Ensure the instruments are properly correlated.

- Mismanaging Time Decay (Theta): Buying long-dated puts as hedges can be a slow bleed. Use shorter expiries or spreads to reduce the impact of time decay.

Conclusion: Why Atomic Hedging Is a Pro-Level Skill

Atomic hedge strategies empower traders to manage risk at a granular level. In today’s dynamic market, being able to stay in a position while minimizing specific risk factors is a major advantage. It is no longer about hedging everything or panicking out of positions; it is about crafting protection where it matters most, based on correlations, catalysts, and capital constraints.

Continue Your Learning

-

How CPI Data Affects The Market

Understand how key economic indicators like the Consumer Price Index influence market volatility and trading opportunities.

-

Is Trading Options Hard? Here’s the Truth

A realistic look at the challenges and opportunities in options trading and what it truly takes to succeed.

-

The Ultimate Guide to Options Greeks

Master Delta, Gamma, Theta, and Vega to understand option pricing and manage your positions like a professional.

Elevate Your Trading Skills

Ready to master professional risk management? Join our community for in-depth education, live sessions, and expert analysis of how to build a winning strategy. Sign up today to start trading with a real edge!

Frequently Asked Questions (FAQ)

Q: What does “atomic” mean in atomic hedge?

A: It refers to the micro-level or granular nature of the hedge, protecting individual components (like atoms) of a trade instead of the entire portfolio.

Q: Is atomic hedging only for advanced traders?

A: Not at all. Even beginners can use simple atomic hedge setups like buying a put spread or an inverse ETF to protect a specific position.

Q: Can I use atomic hedging in a small account?

A: Yes. That’s one of its main advantages. Because it is so targeted, atomic hedging is highly capital-efficient and ideal for small accounts.

Q: How is it different from diversification?

A: Diversification is a passive strategy to reduce risk by owning uncorrelated assets. Atomic hedging is an active strategy to directly neutralize a specific, identified risk in your portfolio for a specific period of time.

Get Actionable Insights Direct to Your Inbox

Get Your Free Trading Edge

Instant access to our weekly market insights

By subscribing, you agree to receive marketing emails from Revolution Trading Pros. Unsubscribe at any time.

- ✓ Weekly Insights

- ✓ No Spam

- ✓ Unsubscribe Anytime

Disclaimer: The content provided in this article is for informational and educational purposes only. It does not constitute financial advice. Trading stocks, options, and leveraged ETFs involves substantial risk and is not suitable for every investor. You could lose all or more of your initial investment. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.