What is Extrinsic Value in Options?

What is Extrinsic Value in Options?

Introduction to What is Extrinsic Value in Options

When trading options, it’s essential to understand how option prices are determined. The price, or premium, of an option consists of two main components: intrinsic value and extrinsic value. Intrinsic value refers to the actual value of the option based on the current price of the underlying asset relative to the strike price. Extrinsic value, on the other hand, reflects all the other factors that influence an option’s price.

So, what is extrinsic value in options? Extrinsic value is also often called time value, but it encompasses more than just the time left until the option expires. It also includes factors like implied volatility, interest rates, and market sentiment. For traders, extrinsic value is a crucial component because it reflects the potential for an option to increase in value based on future market conditions.

In this guide, we’ll dive into what extrinsic value in options is, how it’s calculated, the factors influencing it, and how understanding extrinsic value can enhance your options trading strategies.

Defining What is Extrinsic Value in Options

What is Extrinsic Value in Options?

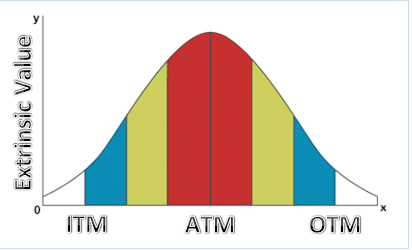

Extrinsic value in options represents the portion of an option’s premium that exceeds its intrinsic value. It accounts for the potential for future price movements and other market factors such as volatility and time decay. In simple terms, it is the amount traders are willing to pay over and above the intrinsic value for the possibility that the option will gain in value before expiration.

Even if an option has no intrinsic value (i.e., it is out of the money), it can still have significant extrinsic value. This is because extrinsic value reflects the possibility that the underlying asset’s price may move in a favorable direction before the option expires.

How is Extrinsic Value in Options Calculated?

The formula for determining extrinsic value in options is:

Extrinsic Value = Option Premium – Intrinsic Value

Where:

- Option Premium is the total price of the option (what you pay to buy it).

- Intrinsic Value is the real, immediate value of the option based on the current price of the underlying asset.

If an option is out of the money, it has no intrinsic value, and its entire premium consists of extrinsic value.

For example, if an option’s premium is $5.00, and its intrinsic value is $3.00, the extrinsic value would be $2.00. If the option is out of the money, the entire $5.00 premium is extrinsic value.

The Key Factors Influencing Extrinsic Value in Options

Several factors affect the extrinsic value in options. Understanding these factors is crucial for traders looking to maximize their profits or minimize risks. Here’s a breakdown of the primary factors that influence extrinsic value in options:

1. Time Until Expiration (Time Decay) and Extrinsic Value in Options

One of the most significant factors influencing what is extrinsic value in options is time decay, or theta, which refers to the rate at which an option loses its extrinsic value as it approaches expiration. The more time remaining until an option expires, the greater its extrinsic value. This is because there is more time for the underlying asset’s price to move in a favorable direction.

As expiration nears, the extrinsic value begins to erode faster. In the final weeks or days before expiration, time decay accelerates, and options can lose a significant portion of their extrinsic value very quickly.

For example, if you buy a call option with six months until expiration, the extrinsic value will be higher than if you buy the same option with only one week until expiration. As the option approaches expiration, the extrinsic value in options diminishes due to the decreasing chance of the underlying asset making a significant price move.

2. Implied Volatility and Its Impact on Extrinsic Value in Options

Implied volatility (IV) is another critical factor in what is extrinsic value in options. It measures the market’s expectation of how much the underlying asset’s price will fluctuate over the life of the option. Higher implied volatility increases extrinsic value because it suggests that the underlying asset has the potential for significant price movements.

When volatility is high, options traders are willing to pay more for the possibility of capturing large price swings, which boosts the extrinsic value. Conversely, low volatility results in lower extrinsic value in options because there is less expectation of significant price movements.

3. Interest Rates and Dividends Impacting Extrinsic Value in Options

Though they play a smaller role compared to time decay and volatility, interest rates and dividends can also affect extrinsic value in options. Rising interest rates can increase the extrinsic value of call options, while a dividend payout might reduce the extrinsic value of call options as the underlying stock’s price typically decreases by the dividend amount on the ex-dividend date.

On the other hand, put options may see an increase in extrinsic value when dividends are announced, especially if the dividend impacts the stock price negatively.

4. Supply and Demand in Extrinsic Value in Options

Like any financial instrument, the extrinsic value in options is affected by supply and demand. If there is high demand for a particular option, its price (and extrinsic value) may increase, even if the intrinsic value remains unchanged. Conversely, if demand is low, the extrinsic value may decline.

Market events, earnings announcements, and significant economic releases often lead to increased demand for options, particularly out-of-the-money options with high potential for price movement. In these scenarios, extrinsic value in options tends to rise.

Examples of What is Extrinsic Value in Options

Let’s explore several examples to illustrate what is extrinsic value in options, how it’s calculated, and how it changes depending on market conditions.

Example 1: A Call Option with Extrinsic Value

Suppose you purchase a call option on Apple (AAPL) with a strike price of $150, and the current market price of AAPL is $140. The option’s premium is $4.00. Since the option is out of the money (the market price is below the strike price), there is no intrinsic value, and the entire $4.00 premium consists of extrinsic value.

Total Premium = $4.00

Intrinsic Value = $0 (Out of the Money)

Extrinsic Value = $4.00

This scenario demonstrates what extrinsic value in options looks like for out-of-the-money options, where the entire premium is made up of extrinsic value.

Example 2: A Put Option with Intrinsic and Extrinsic Value

Now, imagine you purchase a put option on Microsoft (MSFT) with a strike price of $300, and the current market price of MSFT is $290. The premium for the option is $15.00. The intrinsic value is $10.00 (since the strike price is above the market price), and the remaining $5.00 is extrinsic value.

Total Premium = $15.00

Intrinsic Value = $10.00

Extrinsic Value = $5.00

This example illustrates what extrinsic value in options looks like when an option has both intrinsic and extrinsic value. The $5.00 extrinsic value reflects the time remaining until expiration and the potential for MSFT to fall further, increasing the profitability of the put option.

Example 3: How Implied Volatility Affects Extrinsic Value in Options

Let’s consider an options trader holding a call option on Tesla (TSLA), known for its high volatility. The strike price is $800, and the current price of TSLA is $780. The option premium is $25.00. Since the option is out of the money, the intrinsic value is zero, and the entire $25.00 premium is extrinsic value.

Now, if Tesla announces strong earnings, the implied volatility increases as traders anticipate potential price swings. This rise in volatility could increase the option’s premium to $35.00, raising the extrinsic value by $10.00, even though the stock price hasn’t moved. This shows how volatility can significantly affect what extrinsic value in options is.

The Importance of Understanding What is Extrinsic Value in Options

1. Timing Trades Based on Extrinsic Value in Options

One of the key benefits of understanding what is extrinsic value in options is the ability to time your trades effectively. Since extrinsic value decays over time, options traders need to be mindful of when to buy or sell options to avoid losses from time decay.

For example, selling options when extrinsic value is high (and close to expiration) can be profitable, as time decay will rapidly reduce the option’s price. Conversely, buying options with little extrinsic value left and close to expiration can be risky, as the time remaining may not be enough for the option to move in your favor.

2. Determining Fair Pricing Using Extrinsic Value in Options

By understanding what is extrinsic value in options, traders can better assess whether an option is fairly priced. Breaking down the premium into intrinsic and extrinsic components allows traders to determine how much they are paying for time and volatility, as opposed to real, immediate value.

3. Using Volatility and Time Decay to Your Advantage

Options traders often capitalize on volatility and time decay. Knowing what extrinsic value in options means allows traders to take advantage of increasing implied volatility or minimize losses due to time decay.

Common Mistakes When Trading Extrinsic Value in Options

1. Ignoring Time Decay in Extrinsic Value

One common mistake is underestimating the effects of time decay on extrinsic value in options. Holding onto options too long can lead to rapid declines in extrinsic value, particularly as expiration approaches.

2. Overpaying for High Volatility in Extrinsic Value

High implied volatility can inflate the extrinsic value of an option, making it more expensive. Be cautious about overpaying for options with high volatility, as the underlying asset might not move as much as expected to justify the premium.

Conclusion on What is Extrinsic Value in Options

Understanding what is extrinsic value in options is essential for successful options trading. Extrinsic value accounts for factors such as time, volatility, and market sentiment, and it influences how much an option is worth over its intrinsic value.

By mastering what extrinsic value in options is, traders can improve their timing, assess fair pricing, and make more informed decisions. Whether you’re a beginner or an experienced trader, knowing how extrinsic value works is key to optimizing your options trading strategies.

FAQ Section

What is extrinsic value in options, and why is it important?

Extrinsic value is the portion of an option’s premium that reflects factors like time, volatility, and market conditions. It’s important because it influences how much an option is worth beyond its intrinsic value.

How does time decay affect extrinsic value in options?

Time decay, or theta, gradually reduces the extrinsic value of an option as it approaches expiration. The closer the option gets to expiration, the faster extrinsic value erodes.

Can an out-of-the-money option have extrinsic value?

Yes, out-of-the-money options can still have extrinsic value based on time remaining, implied volatility, and the potential for the underlying asset’s price to move in a favorable direction before expiration.

Check out our articles on:

- Introduction to Options Trading

- Mastering Butterfly Spreads

- The Power of Diagonal Spreads

- The Power of Iron Condors

- The Power of Vertical Credit Spreads

Elevate Your Options Trading Skills

Ready to master trading options? Join our community for in-depth education on options trading, live trading sessions, and expert analysis of options trading strategies. Sign up today to start profiting from market swings using advanced options trading strategies!

Below are the links:

To your success,

Billy Ribeiro is a renowned name in the world of financial trading, particularly for his exceptional skills in options day trading and swing trading. His unique ability to interpret price action has catapulted him to global fame, earning him the recognition of being one of the finest price action readers worldwide. His deep comprehension of the nuances of the market, coupled with his unparalleled trading acumen, are widely regarded as second to none.

Connect with us: