The 3 Best Option Trading Strategies

The 3 Best Option Trading Strategies

Elevate Your Trading with Vertical Debit Spreads, Vertical Credit Spreads, and Broken Wing Butterflies

Introduction

Options trading offers a range of strategies to help traders manage risk, enhance returns, and adapt to various market conditions. In this comprehensive guide, we will explore three of the best option trading strategies: Vertical Debit Spreads, Vertical Credit Spreads, and Broken Wing Butterflies. Each strategy offers unique advantages and can be tailored to fit different trading styles and market environments. Whether you are a seasoned trader or just starting, understanding these strategies will provide you with valuable tools to navigate the options market successfully.

Vertical Debit Spreads: A Powerful Strategy for Directional Trades

What are Vertical Debit Spreads?

A Vertical Debit Spread, also known as a net debit spread, involves simultaneously buying and selling options of the same type (calls or puts) with the same expiration date but different strike prices. This strategy creates a spread where the premium paid for the long option exceeds the premium received for the short option, resulting in a net debit. Vertical Debit Spreads are often used when a trader expects a significant move in the underlying asset’s price.

Mechanics of Vertical Debit Spreads

Example with Bull Call Spread

Consider an example with Apple (AAPL). If you are bullish on AAPL and expect its stock price to rise, you could buy a call option with a strike price of $180 for $500 and sell a call option with a strike price of $190 for $300. Your net debit would be $200, which is the maximum loss you can incur. If AAPL’s price rises to $195 at expiration, your profit would be $300 ([$195 – $190] x 100 shares – $200 debit).

Bear Put Spread for Bearish Scenarios

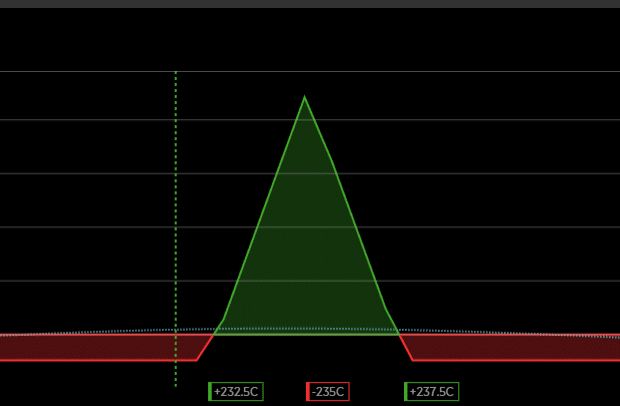

In a bearish scenario, suppose you anticipate a decline in Tesla (TSLA). You might buy a put option with a strike price of $250 for $600 and sell a put option with a strike price of $240 for $400. Your net debit would be $200. If TSLA’s price drops to $235 at expiration, your profit would be $300 ([$240 – $235] x 100 shares – $200 debit).

Advantages of Vertical Debit Spreads

- Defined Risk: The maximum loss is capped at the net debit paid, providing a clear risk profile.

- Lower Capital Requirement: Requires less capital than buying outright options or stocks.

- Directional Flexibility: Can be used for both bullish and bearish market expectations.

Vertical Credit Spreads: Income Generation with Defined Risk

Understanding Vertical Credit Spreads

A Vertical Credit Spread involves selling an option with a higher premium and buying an option with a lower premium of the same type (calls or puts) with the same expiration date but different strike prices. This strategy results in a net credit, as the premium received from the short option exceeds the premium paid for the long option. Vertical Credit Spreads are typically used to generate income with a defined risk.

Mechanics of Vertical Credit Spreads

Bull Put Spread Example

If you are bullish on Amazon (AMZN), you could implement a Bull Put Spread by selling a put option with a strike price of $3000 for $1,200 and buying a put option with a strike price of $2900 for $800. Your net credit would be $400. If AMZN stays above $3000 at expiration, you keep the entire credit as profit.

Bear Call Spread for Bearish Outlooks

In a bearish outlook, consider implementing a Bear Call Spread on the S&P 500 ETF (SPY). You might sell a call option with a strike price of $450 for $500 and buy a call option with a strike price of $460 for $300. Your net credit would be $200. If SPY remains below $450 at expiration, you retain the credit as profit.

Benefits of Vertical Credit Spreads

- Income Generation: Provides a way to earn premium income with a high probability of profit.

- Defined Risk: The risk is limited to the difference between strike prices minus the net credit received.

- Versatility: Can be used in bullish, bearish, or neutral market conditions.

Broken Wing Butterflies: A Strategy for Low-Cost, High-Reward Opportunities

What is a Broken Wing Butterfly?

A Broken Wing Butterfly is an advanced options strategy that involves creating a butterfly spread with an uneven wing, typically to skew the risk/reward profile. This strategy combines buying and selling options at different strike prices, creating a position that can benefit from low-cost, high-reward opportunities, especially in low-volatility environments.

Mechanics of Broken Wing Butterflies

Example with SPY

Suppose you expect SPY to stay within a certain range but with a slight bullish bias. You could create a Broken Wing Butterfly by:

- Buying one SPY $440 call for $3

- Selling two SPY $450 calls for $2 each

- Buying one SPY $460 call for $0.50

Your net debit would be $0.50. If SPY closes near $450 at expiration, you can achieve significant profits due to the skewed wings, with your maximum loss limited to the net debit paid.

Advantages of Broken Wing Butterflies

- Low Cost: Typically involves a low initial cost, making it an attractive strategy for risk-averse traders.

- High Reward Potential: Offers high profit potential if the underlying asset remains within the target range.

- Defined Risk: The risk is clearly defined and limited to the net debit paid.

Choosing the Right Strategy for Your Trading Goals

Assessing Market Conditions

When choosing between Vertical Debit Spreads, Vertical Credit Spreads, and Broken Wing Butterflies, it is essential to assess the current market conditions and your market outlook. Bullish, bearish, and neutral scenarios require different strategies to optimize returns and manage risk effectively.

Aligning Strategies with Risk Tolerance

Understanding your risk tolerance is crucial. Vertical Debit Spreads and Broken Wing Butterflies may suit traders looking for high reward opportunities with defined risks, while Vertical Credit Spreads offer consistent income with a high probability of profit and defined risks.

Combining Strategies for Diversification

Diversifying your options trading strategies can enhance your overall portfolio performance. By combining Vertical Debit Spreads, Vertical Credit Spreads, and Broken Wing Butterflies, you can create a balanced approach that leverages the strengths of each strategy.

Conclusion

Options trading offers a wealth of opportunities for traders to enhance their returns and manage risk. By mastering Vertical Debit Spreads, Vertical Credit Spreads, and Broken Wing Butterflies, you can significantly elevate your trading game. Each of these strategies provides unique benefits and can be tailored to suit different market conditions and trading goals. We hope this guide has provided you with valuable insights and practical knowledge to help you navigate the options market successfully. Remember, the key to successful trading lies in continuous learning, disciplined execution, and adapting to the ever-changing market environment.

Check out our article on:

Elevate Your Trading Game

Ready to take your options trading to new heights? Whether you’re a day trader, swing trader, or busy professional, we have you covered. Join our exclusive community of traders and gain access to our comprehensive educational resources, live trading sessions, and expert analysis. We’ll guide you through the intricacies of debit spreads and other advanced options strategies, helping you achieve your financial goals. Don’t miss out on this opportunity to become a more confident and profitable trader. Sign up today!

Below are the links for Our Live Trading Rooms:

To your success.

Billy Ribeiro is a renowned name in the world of financial trading, particularly for his exceptional skills in options day trading and swing trading. His unique ability to interpret price action has catapulted him to global fame, earning him the recognition of being one of the finest price action readers worldwide. His deep comprehension of the nuances of the market, coupled with his unparalleled trading acumen, are widely regarded as second to none.

Connect with us: